With the internet and increasingly advanced procurement practices, how to “cut out the middleman” is therefore often being considered. Yet, trade intermediaries prevail and appear to be performing well in several industries. Furthermore, a globalised trade environment with deeper and more complex supply chains, creates a need for entities who have local knowledge, global networks, logistics competences, and can deliver products and services with high quality at competitive prices (Gereffi et al., 2005). In that regard, understanding the role of trade intermediaries and other middlemen is in our opinion only gaining in importance.

With the internet and increasingly advanced procurement practices, how to “cut out the middleman” is therefore often being considered. Yet, trade intermediaries prevail and appear to be performing well in several industries. Furthermore, a globalised trade environment with deeper and more complex supply chains, creates a need for entities who have local knowledge, global networks, logistics competences, and can deliver products and services with high quality at competitive prices (Gereffi et al., 2005). In that regard, understanding the role of trade intermediaries and other middlemen is in our opinion only gaining in importance.

Conceptualization of the Supply Chain

Following the seminal definition from Mentzer et al. (2001), a supply chain is understood as a set of three or more entities that are involved directly in product, service, information, and financial flows between a source and a customer. The ‘product’ often lies at the heart of the supply chain. Carter et al. (2015) even suggest that the supply chain is relative to the product in question and distinguish between the physical supply chain and the support supply chain.

While the above supply chain conceptualisation appears rather simple, supply chains tend to be messier in reality. With globalisation and vertical disintegration, many supply chains have become highly complex. Globalisation introduces a number of distances to the supply chain; hereunder physical and cultural, while vertical disintegration tends to add several nodes to the chain. As a result, Carter et al. (2015) have argued that factors of distance (physical and cultural distance as well as closeness centrality) tend to attenuate (i.e. make fuzzier) the supply chain from a focal agent’s perspective and ultimately create a visible boundary.

The position of trade intermediaries in supply chains, however, remains unclear. Many trade intermediaries possess features from both the physical (e.g. as a product owner) and the support chain (e.g. as a provider of trade credit) and work across large distances (e.g. across continents). Hence, the following sections aim at positioning trade intermediaries in modern supply chains and explaining their role.

The Emergence of Intermediated Supply Chains

To understand trade intermediaries, we used meta-theories that offer explanations to the emergence and behaviour of supply chains. These theories explain competitive advantage due to firms’ resources, capabilities and configurations, the institutional set-ups of supply chains, and the dynamics of inter-organisational relationships (Halldórsson et al., 2007). Within the realm of supply chain management, the most common meta-theories applied are the resource-based view (RBV), transaction cost economics (TCE) and network theory (NT). These three theories provide three different units and levels of analysis for conceptualising supply chains including intermediaries, namely the firm, the dyad and the network.

Resource Needs Make Room for Trade Intermediaries

The first theory, RBV, originates from the domain of strategic management and emphasizes the internal aspects of a firm as key to success. To obtain competitive advantages, firms need to develop superior resources and capabilities. Jay Barney (1995) suggested that the strength of a firm’s resources and capabilities are dependent on four aspects (the so-called VRIO framework): whether resources are valuable, rare, inimitable (and non-substitutable), and whether the firm is organised to exploit them. If a firm needs another firm’s resources, it will have no option but to build those resources internally or acquire them on the market (Barney, 1999).

To develop and sustain competitive advantages, it is further argued that firms need to (re)orientate themselves towards their core competences (Prahalad and Hamel, 1990). Most firms face constraints and must prioritise between initiatives and activities. From that naturally follows that an orientation towards defined core competences entails non-core competences to potentially being out-sourced and hence, we see the emergence of a supply chain.

Likewise, firms may transact and effectively form a supply chain when they eye the opportunity to generate so-called relational rent. This is possible when firms make relationship specific investments, develop strong knowledge sharing routines, have complementary resources, and establish effective governance (Dyer and Singh, 1998).

The RBV and Relational Rent’s take of supply chain emergence essentially boils down to three different explanations: a) Supply chains emerge when a firm possesses superior resources that other firms need but cannot build or acquire themselves, e.g. due to their VRIO nature, b) When two firms build superior resources embedded in a relationship forming relational rent, or c) When a firm’s prioritisation of its core-competences leads it to out-source non-core activities.

Trade Intermediaries Lower Costs of Transacting

Developed by Ronald Coase and Oliver Williamson, TCE, explains why firms exist and the mechanisms that determine the scale and scope of firms. Taking a stance against neoclassical orthodox explanations, Coase (1937) postulated that firms emerge when frictions (transaction costs) occur in the market, rendering insufficient information or skewed information balance between economic actors.

Building on this, Williamson (1996) introduced a few concepts to supplement Coase’s seminal paper. Firstly, he assumed that participants in an economic system are rationally bounded, meaning that they often have insufficient information and/or a limited capacity to process information. As a result, opportunistic behaviour can be adopted, a type of behaviour he explained as “calculative efforts to mislead, confuse and disguise” (Williamson, 1996, p. 56).

Secondly, he introduced three operational measures pertaining transactions, being the frequency with which they occur, the uncertainty they are subject to, as well as their asset specificity (redeployability). Based on these three characteristics, transactions are organised and aligned with a specific governance structure. Williamson (1996) describes a market governance structure and a hierarchy (firm) governance structure along the lines of Coase’s suggestions, where firms opt for a market governance structure in a low transaction cost environment (e.g. commoditised, standard, non-complex products) and a hierarchy governance structure in a high transaction cost environment (e.g. when dealing with proprietary recourses and few suitable suppliers).

More interestingly from a supply chain perspective, however, Williamson (1996) introduces the concept of a hybrid governance structure. This mode of governance prevails when transaction costs arise in relation to mediating business exchanges in the market (e.g. due to opportunism) while the bureaucratic costs of organising the transaction internally are equally high (Williamson, 2008). In order to overcome such situations in a supply chain and to lower the associated cost of transacting, actors opt for interfirm contracting.

Network Dynamics Constantly Affects the Nature of Inter-Organisational Relations

While RBV and TCE explain why firms transact and form supply chains, NT teaches us how industrial networks and hence supply chains behave. NT offers a more holistic and collaborative alternative to the firm-centred theories within strategic management and its traditional ‘winning doctrine’ (Gadde et al., 2003).

A key feature of NT is the network model of organisation-environment interface. This model postulates that an organisation’s environment tends to be structured around a limited number of organisations with which it develops a close relationship through continuous exchange and interaction processes, allowing them to access each other’s resources and creating mutual knowledge and capabilities, and in this way, an industrial network can be seen as a web of interdependent relationships (Håkansson and Snehota, 1989).

Within social NT, Granovetter (1973) argued that the degree of overlap in two persons’ networks depends on strength of the two persons’ personal tie. Strong personal ties tend to exist between members of the same group, and thus Granovetter stressed the strength of people’s weak ties as these tend to extend beyond one’s own group and therefore grant access to fresh information and new ideas. A similar point can be made within a business context where employees who can bridge structural holes through their weak ties can be particularly valuable to an organisation (Burt, 2004).

An Integrated Framework of Supply Chain Emergence

Integration of the three theoretical perspectives can now explain why supply chains including trade intermediaries emerge and how they behave. The degree of transaction cost dictates whether it is most reasonable to internalise an activity or access it from an external party. And in instances, where firms need to access a certain resource which they cannot acquire for themselves or effectively imitate, they need to transact with another company (Barney, 1999). As such, the RBV provides an explanation of the emergence of the supply chain by suggesting that firms’ resource needs and core competence force the formation of the supply chain.

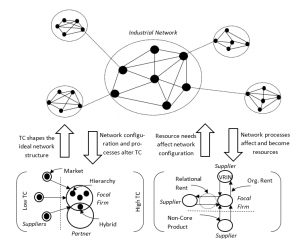

After its formation, the network, however, remains in flux. Continuous exchange and adaptation processes lead to new shared knowledge and capabilities in the network (Håkansson and Snehota, 1989). Thus, network dynamics impact the network’s resource pool. Likewise, the transaction cost landscape may be altered by these processes. The weak ties of the network actors may diffuse valuable information into the network (Granovetter, 1973), providing network members with a better basis for making decisions reducing the room for opportunism (Williamson, 1996). Moreover, it is imaginable that the repeat transactions within a network may lead to new assets like trust and effective governance structures, which again may reduce transaction cost. These forces are illustrated in figure 1 below.

Figure 1 An intergrated framework explaining supply chain emergence. Source: Bock and Sørensen.

Chr. Olesen A/S – the case of a Danish “Middleman”

The international distribution company Chr. Olesen A/S (https://www.chr-olesen.dk/essentials/) enables us to deploy the framework in an authentic context. Chr. Olesen is a distributor with global operations, which has experienced substantial growth over the last three decades reaching an annual revenue of €336m in 2019 and employing around 55 people. Today, Chr. Olesen is active around three main product segments, being ingredients and additives to the feed, food, and pharmaceutical industries. Besides buying and selling products within these segments, Chr. Olesen provides a number of product related services, counting finance, logistics (transport, documentation, and storage), and quality assurance.

The Merchant and The Machine

Trade lies at the heart of a trade intermediary, and in this regard, Chr. Olesen is no exception. Chr. Olesen’s Product Managers are responsible for buying and selling. In addition to trading, these ‘merchants’ are responsible for monitoring their product markets thoroughly as well as providing advice to customers and suppliers with regards to pricing and quantity. Like many other intermediaries, Chr. Olesen are more than mere traders. Chr. Olesen’s product sales are accompanied by a set of auxiliary services such as logistics, finance and quality assurance, delivered by other staff-members who are organised centrally in the company and shared across its ‘merchants’. Figuratively, these centrally performed auxiliary services can be understood as the companies’ operations, the ‘machine’.

The Trade Intermediary as a Set of Complementary Resources

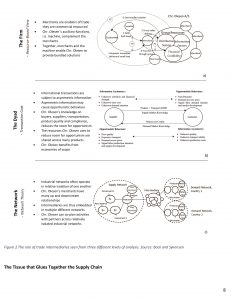

The merchants in Chr. Olesen have a large network to different suppliers and customers across many different industrial networks. Their continuous work with and within these networks makes them capable of accessing and diffusing valuable knowledge (see Granovetter, 1973) and allows them to act as commercial gateways through which trade can flow. In this way, merchants can secure trade and are therefore valuable resources. The machine, on the other hand, is capable of arranging a wide array of services, which reduces the number of practical tasks that buyers and suppliers would otherwise face when purchasing or selling. The machine, however, has little value on a standalone basis. For it to add value there must be a product sale. In this way, machines are complementary resources to merchants. When a trade intermediary therefore manages to connect its merchants with a machine, it links supply chain nodes economically by arranging a number of tasks into bundled solutions (see figure 2). Drawing on RBV, we may say that firms use trade intermediaries because of their resources – merchants and machines – and their ability to complement each other.

Scope Advantages Enables Cheap Alleviation of Transaction Costs

International goods transactions may be subject to severe information asymmetries due to e.g. geographical, cultural and linguistic barriers (Rivera et al., 2010) spawning the risk of opportunistic behaviour related to not knowing the quality of a product, the quality of transportation, the financial situation of the customer, or otherwise having insufficient information of the demand and supply situation (see figure 2b). Context specific know-how possessed by trade intermediaries such as Chr. Olesen can alleviate many of these asymmetries, as their bundled solutions provide a vehicle to counteract associated costs embedded in international buyer-supplier dyads.

A relevant question in that regard is why then Chr. Olesen’s functions are not internalised? Following TCE, it is due to the fact that they have a machine that can coordinate these functions at a lower relative cost than either the buyer or supplier. The reason, more specifically, lies in the frequency of transactions Chr. Olesen can obtain. Production firms seek economies of scale through specialisation, often focusing on core competences and relatively few products. Warehouse operation, planning in and outbound logistics, obtaining certificates, and providing trade credits to customers require a set of resources. If used only across a narrow set of products, these resources will be used infrequently. Chr. Olesen and other trade intermediaries on the other hand, have many products across multiple different buyers and suppliers around which they can deploy their machine. In other words, trade intermediaries benefit from economies of scope.

The Trade Intermediary as a Network Bridger

NT notes that industrial networks often emerge as relatively concentrated structures within which relatively few companies collaborate (Håkansson and Snehota, 1989). This resonates well with the view of attenuated and visibly bounded supply chains (Carter et al., 2015). It is relatively clear what happens within one’s own network, but what happens beyond is less clear. Trade intermediaries and their merchants differ from other companies in that they are embedded in multiple different industrial networks (see figure 2c). Chr. Olesen’s merchants have close connections to many upstream production networks (often in Asia) and many downstream networks (often in Europe) that tend to operate in relative isolation. We might say that trade intermediaries can bridge industrial networks through the strong ties of the merchants who appear to operate in the structural holes between networks. This position between networks enables trade intermediaries to co-plan activities with strong-tied partners, and their connections to weaker-tied partners enable diffusion of information across more distant networks. In this way, trade intermediaries position themselves in a fashion that increases supply chain orientation and ultimately support the achievement of supply chain management, which presumes systemic coordination across the chain (see Mentzer et al., 2001).

Figure 2 The role of trade intermediaries seen from three different levels of analysis. Source: Bock and Sørensen.

The Tissue that Glues Together the Supply Chain

The case of Chr. Olesen helps explain why intermediaries exist in modern supply chains. While trade intermediaries may obtain price discounts by placing large order at their suppliers enabling them to deliver a good price, it is clear that their role in supply chains extends well beyond this function. Trade intermediaries have the ability to bridge industrial networks and help facilitate international goods transactions even across large distances (both cultural and geographic). In doing so, the merchants are aided by their machine that manages to complement the actual product sale with a number of practical services. It would be wrong to assume that a purchase is just a purchase. For a purchase to work, many tasks, often subject to industry specific standards, must be performed, be it in the form of logistics, finance, or quality assurance. In this way, Chr. Olesen’s resource configuration enables them to fix ‘all the other things’ associated with a purchase and spare a lot of work for the supplier and the buyer. Moreover, the trade intermediary has the ability to reduce the threat from asymmetric information and opportunism in international transactions, e.g. through the knowledge of their merchants, the know-how of their logistics department, or the information producing capacity of the quality assurance department. In alleviating information asymmetry and arranging ‘all the other things’, a trade intermediary like Chr. Olesen can benefit from economies of scope as they can deploy the machine that fulfils these functions across many different product lines, and thus deliver this service at very competitive rates. Hence, one can describe the trade intermediary as an organisation that functions as a form of commercial tissue binding together the actors in the global supply chain.

References

Barney, J. (1995). Looking inside for Competitive Advantage. The Academy of Management Executive (1993-2005), 9(4), 49-61.

Barney, J.B. (1999). How a firm’s capabilities affect boundary decisions. Sloan Management Review, 40(3), 137-148.

Burt, R. S. (2004). Structural Holes and Good Ideas. American Journal of Sociology, 110(2), 349–399.

Carter, C.R., Rogers, D.S. & Choi, T.Y. (2015). Toward the theory of the supply chain. Journal of Supply Chain Management, 51(2), 89-96.

Coase, R. H. (1937). The Nature of the Firm. Economica, 4(16), 386-405.

Dyer, J.H., & Singh, H. (1998). The Relational View: Cooperative Strategy and Sources of Interorganizational Competitive Advantage. The Academy of Management Review, 23(4), 60-679.

Gadde, L., Huemer, L., & Håkansson, H. (2003). Strategizing in industrial networks. Industrial Marketing Management, 32(5), 357-364.

Gereffi, G., Humphrey, J. & Sturgeon, T. (2005). The Governance of Global Value Chains. Review of International Political Economy, 12(1), 78-104.

Granovetter, M.S. (1973). The Strength of Weak Ties. American Journal of Sociology, 78(8), 1360-1380.

Halldórsson, Á., Kotzab, H., Mikkola, J.H. & Skjoett-Larsen, T. (2007), Complementary theories to supply chain management, Supply Chain Management: An International Journal, 12(4), 284-96.

Håkansson, H., & Snehota, I. (1989). No business is an island: The network concept of business strategy. Scandinavian Journal of Management, 5(3), 187-200.

Mentzer, J.T., DeWitt, W., Keebler, J.S., Min, S., Nix, N.W., Smith, C.D., & Zacharia, Z.G. (2001). Defining Supply Chain Management. Journal of Business Logistics, 22(2), 1-25.

Prahalad, C.K., & Hamel, G. (1990). The Core Competence of the Corporation. Harvard Business Review 68(3), 70-91.

Rivera, M.T., Soderstrom, S.B. & Uzzi, B. (2010). Dynamics of dyads in social networks: Assortative, relational, and proximity mechanisms, Annual Review of Sociology, 36(1), 91-115.

Spulber, D. (1996). Market Microstructure and Intermediation. Journal of Economic Perspectives, 10(3), 135-152.

Williamson, O.E. (1996). The Mechanisms of Governance. New York / Oxford: Oxford University Press.

This article is based on Martin Bock’s and Mads Eklundh Sørensen’s master’s thesis which was awarded the Kinaxis Award for Best CBS EBA-SCM Thesis (cand. merc.) in 2020 at the 9th Supply Chain Leaders Forum in 2020. The thesis explores the role of trade intermediaries in modern and increasingly complex global supply chains. The case presents an in-depth case study of the Danish family owned company Chr. Olesen A/S which is a 135-year-old distributing company of a.o. vitamins to the Feed, Food and Pharma industry all over the world.

This article has been written in collaboration with CHRO Alice Louise Wedell-Neergaard, Chr. Olesen, whose comments and inputs to the article were greatly appreciated. Britta Gammelgaard was supervisor of the thesis.